YRITTÄJÄ, tule mukaan omiesi pariin! Liity Yrittäjiin.

Business Cost Support III open for applications today — includes single-person business support and Closure Compensation

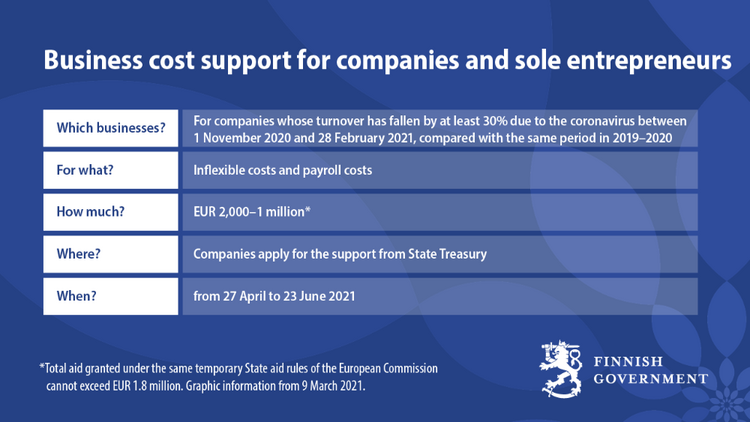

Applications for the third round of Business Cost Support open today on 27 April 2021, and applications for Closure Compensation open on 12 May 2021. Applications for Business Cost Support close on 23 June. The closing date for applications for Closure Compensation has not yet been decided. Single-person businesses can receive support of at least €2,000. Businesses that have closed can also apply for Business Cost Support.

Parliament approved the third round of Business Cost Support on Friday 9 April. Even though the basis for the support is the same, the criteria and focus have changed slightly from round to round. The support has been developed based on feedback and experience.

In addition to Business Cost Support, the current round of support includes Closure Compensation for microbusinesses and small businesses that were forced to close on official orders.

Applications for the third round of Business Cost Support open today on 27 April 2021, and applications for Closure Compensation open on 12 May 2021. Businesses can apply to the State Treasury for both.

Mika Kuismanen, Chief Economist at Suomen Yrittäjät, says, “Businesses need to apply for each form of support separately, and as a business owner you should be aware of this.”

Business Cost Support is intended for companies whose turnover has decreased by over 30% between 1 November 2019—29 February 2020 and 1 November 2020—28 February 2021 (the “support period”).

Microbusinesses and small businesses whose public premises have been closed by law or official order can apply for the Closure Compensation.

The Business Cost Support Act has been amended to allow support to be paid more flexibly to single-person businesses and small business, as well as to allow the new Closure Compensation to businesses closed because of the pandemic. The President signed the amendments into law on 9 April, and the Act came into force on 12 April 2021.

Business minister Mika Lintilä says, “We are currently also preparing Closure Compensation and an event guarantee for large businesses.”

Business Cost Support for all sectors

Companies in all sectors of the economy can apply for Business Cost Support. On 22 April, the Government amended the Business Cost Support Decree in April to update the list of sectors that can apply for support without additional grounds. These are sectors in which turnover has decreased by at least 10% during the support period. If a business is not in one of these sectors in the Decree in which turnover has dropped 10% or more, it must specifically explain why its turnover has decreased due to COVID-19.

Business Cost Support is compensation for a business’s inflexible expenses and wages, but it does not compensate lost sales. Inflexible expenses have now been defined more precisely in the Act. In addition, a certain proportion of employers’ expenses, such as social security contributions and occupational healthcare costs, can be compensated in future.

Single-person businesses to apply to State Treasury for support in future

A business will be paid at least €2,000 if the conditions for support are met. Support is awarded in accordance with the decrease in a business’s turnover and its real costs.

A business must have a business ID to apply for Business Cost Support. Another requirement is that the company must have had acceptable costs of at least €2,000 during the support period.

The maximum support amount is now larger, which particularly meets large businesses’ needs. A business may receive up to €1 million, compared to the maximum of €500,000 in previous rounds.

Mika Kuismanen says, “Business Cost Support III still has flaws: the required decrease in turnover is still 30%, when it should be 20–25%. The proportion of turnover for which a business’s support is not calculated is too high, and the minimum support amount paid should be €1,000.”

Closure Compensation for small businesses

Businesses can receive Closure Compensation if they were forced to close their premises by law or official order due to the COVID-19 pandemic. The new Closure Compensation is available to microbusinesses and small businesses with a maximum of 49 employees.

Businesses that have closed can also apply for Business Cost Support.

Closure Compensation for larger businesses is being prepared. The Ministry of Employment and the Economy is currently negotiating with the European Commission on the terms and maximum amount for large business support.

Closure Compensation is available to restaurants and other food businesses that closed temporarily to customers under the Act on Accommodation and Catering Operations. However, takeaway sales of food are permitted. Compensation will be calculated for the share of operations forced to close.

Businesses that a municipality or Regional State Administrative Agency ordered to close under the Communicable Diseases Act can also receive compensation. These include exercise and sport premises, gyms, public saunas, swimming pools, spas and indoor playgrounds.

Closure Compensation based on a business’s expenses in February 2021

Compensation will be paid to businesses for the period in which they were closed. If a business had reduced customer capacity, but not closed completely, it is not eligible for Closure Compensation.

Closure Compensation is based on a business’s expenses in February 2021 and its own notification of how large a share of trading is affected by the closure. Wage expenses will be compensated 100% and other expenses, such as rent, will be compensated 70%.

Previously awarded COVID-19 support will be considered when deciding the amount of Business Cost Support and Closure Compensation paid. Under EU state aid rules, the maximum amount of support is €1.8 million.

Applications for Business Cost Support will be open until 23 June 2021. A business must apply for Closure Compensation within four months of the end of the last calendar month in which it was forced to keep its premises closed.

Applications for the first round of Business Cost Support were open in July and August 2020. The second round began in December 2020 and ended in February 2021. A total of €356 million has been allocated for Business Cost Support III and Closure Compensation.

Watch the infowebinar 3.5.2021 at 2 pm. Third round of business cost support and closure compensation.