YRITTÄJÄ, tule mukaan omiesi pariin! Liity Yrittäjiin.

SME barometer: poorer outlook and weaker investment appetite, but faith in growth long-term

Almost half the respondent businesses say the war in Ukraine has negatively affected their business or production. A similar number of small and medium-sized enterprises (SMEs) have not felt any impacts.

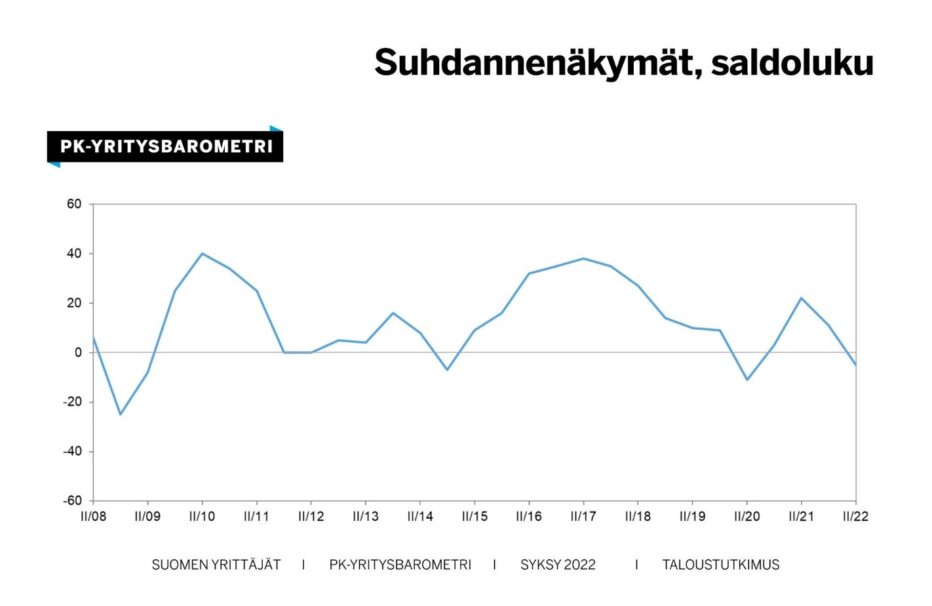

SMEs’ outlooks on the economy in the near future are poorer than at the start of the year. This is indicated by the SME barometer, which Suomen Yrittäjät, Finnvera and the Ministry of Employment and the Economy publish twice a year. This time, around 4,800 business responded to the survey. The survey was open for answers in June and July 2022.

The Russian invasion of Ukraine affects SMEs’ business environment in several ways. The impacts are much broader than SMEs exposed directly to Russian risks in their businesses.

Almost half the respondent businesses say the war in Ukraine has negatively affected their business or production. A similar number of small and medium-sized enterprises (SMEs) has not felt any impacts. In contrast, only a few per cent of SMEs consider Russia’s invasion of Ukraine to have had a positive effect on their business or production.

In addition, global production chains have not fully recovered from the Covid pandemic, and the energy market is in turmoil.

Conditions for doing business need improvement

As recently as the start of this year, SMEs’ outlooks improved markedly following the end of pandemic restrictions, and economic expectations rose strongly. Now, the autumn SME barometer’s net scores, which sum up businesses’ economic expectations and investment intentions, are negative. However, around half of SMEs consider that the economic conditions will remain the same.

“Many business owners are now feeling these uncertain times tangibly, as the results of the SME barometer results show. Happily, the results are not hopeless. Opportunities for growth still abound and it is by seizing them and developing commercial opportunities that businesses can survive uncertain times,” Minister for Employment and the Economy Mika Lintilä says.

The minister says that in this situation, the conditions for doing business must be improved.

“At the budget session, we made important decisions, particularly to support the vitality of eastern Finland, such as by supporting accessibility and developing skills. The effects of Russia’s war of aggression are seen everywhere, but in particular in eastern Finland,” Lintilä stresses.

Investments down

A large number of SMEs intends to retain its current staff. One SME in ten expects its headcount to decline. Of SMEs, 17% intend to take on more employees.

The outlook on the economy affects investment appetite. SMEs expect to significantly reduce their investments in the near future. All main sectors, apart from industry, have had more businesses that were reducing investments than those that were increasing them.

“Something positive about the otherwise weak investment expectations was that the expectations of SMEs seeking strong growth have not dropped significantly since the last barometer. This may indicate that growth expectations will not drop across the entire economy over the long term,” Mika Kuismanen, Chief Economist at Suomen Yrittäjät, says.

Turnover expected to grow

SMEs strongly expect that production costs will rise. In particular, the prices of raw materials and other intermediate goods is expected to rise quickly.

“Businesses’ increased capacity for raising the prices of their own products and services may not fully compensate the rise in prices of intermediate goods,” Kuismanen says.

Businesses’ profitability expectations have dropped severely, with the net score for this parameter dropping below zero since the spring barometer. A positive aspect is that a larger group, around 40% of SMEs, expects its turnover to grow over the next year, with only one-fifth expected it to drop.

Less cooperation with campuses

Cooperation on innovation between businesses and educational institutes has also decreased. Businesses’ expectations of the benefits of cooperation with educational institutes, research bodies and enterprise promotion agencies are lower than in spring 2021.

A significant group of SMEs cooperates with educational providers, research organizations and enterprise promotion agencies. The most common cooperation partners are vocational schools and colleges, private education service providers, and universities of applied science. In comparison, cooperation with universities and research institutes is on a significantly smaller scale, in addition to which fewer businesses than before conduct such cooperation.

Among the forms the cooperation takes, education and final-year projects have retained their popularity.

Finnvera guarantees significant

Strict bank regulation and businesses’ poorer credit eligibility are reflected in SMEs’ financing, as guarantees provided by Finnvera are highly significant in securing finance. One in three SMEs that had applied for financing from a bank said that securing the finance required a Finnvera guarantee. This is particularly important for the most growth-oriented businesses.

“On the whole, significant changes have not occurred in availability of finance, which remains at a reasonably good level. It is particularly important to ensure availability of finance for projects which respond to current extensive disruptions, such as the energy disruption and the reconfiguration of global supply chains. We are ready to help make this happen with a broad range of guarantees, loans and growth loans,” Juuso Heinilä, Executive Vice President at Finnvera, says.